Retentions - New in Ascora!

Do you work in construction and need to manage Retentions in your invoicing? Ascora now includes full Retention management – making it easy to keep track of the Retention money you are owed and helping you claim withheld money as quickly as possible!

Ascora will keep track of the Retention amount on a per-invoice level and then notify you when the completion and final Retention invoices are due.

To start using Retentions in Ascora:

Configure Default Information for Retentions

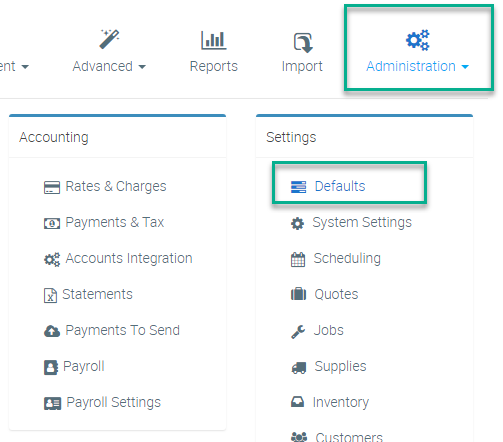

1. Hover the mouse pointer over the Administration Icon in the Top Menu and choose Defaults from the dropdown menu. The Default Settings Screen will display.

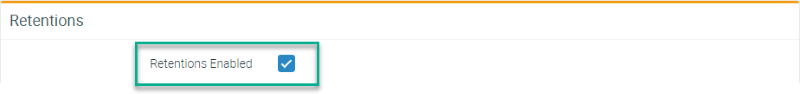

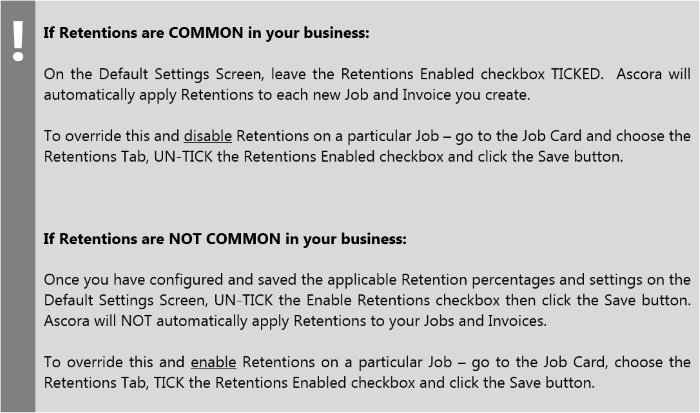

2. Scroll down the screen to locate the Retentions section. Tick the checkbox to enable Retentions.

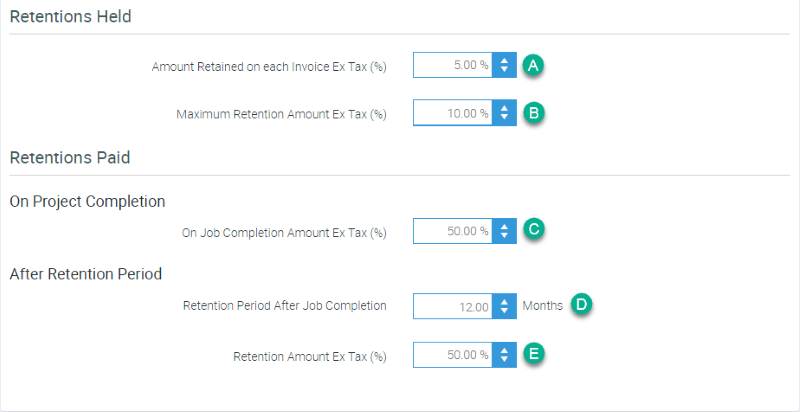

3. The Retentions default options will display. Enter your common Retention percentages and set the period for which you will issue the Final Retention Invoice.

A – The percentage from each Invoice that will be retained

B – The maximum percentage (of the total project value) that can be Retained across the entire project

C – The percentage of retained amounts that will be Invoiced on project completion

D – The period of time after the project is complete before Invoicing for the final balance of Retentions

E – The percentage of Retained amounts that will be Invoiced after the defined time period (D) for the Final Retention Invoice

Note that the percentage values for C and E will automatically adjust to achieve a total of 100%.

4. Click the Save button at the top of the screen to save your Retention defaults.

Retentions on a Job

Once you have enabled Retentions – either by default on the Default Settings Screen, or for a particular Job by ticking the Retentions Enabled checkbox under the Retentions Tab on the Job Card – the Retention values generated will be based on your default Retention settings and the total value of the Job.

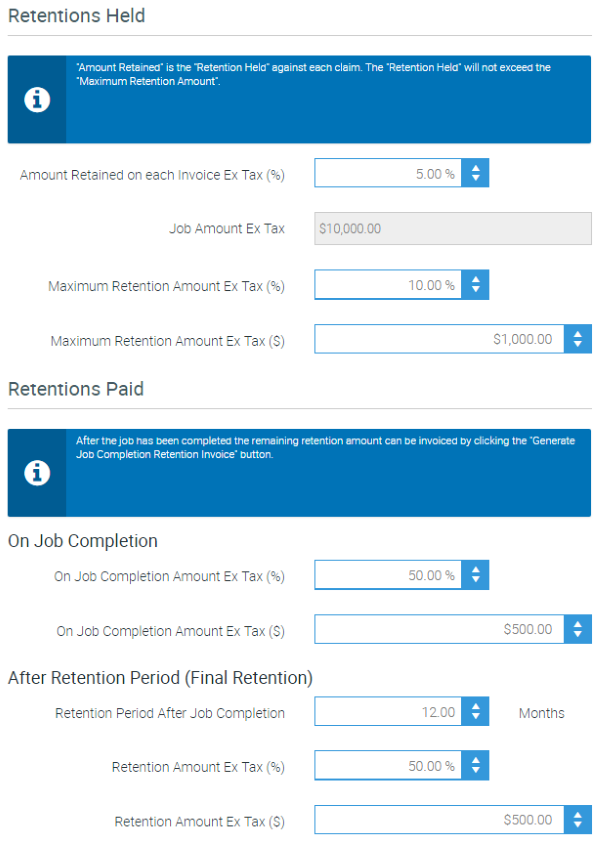

For example, on a $10,000 ex GST Job, the Retentions Tab would show the following:

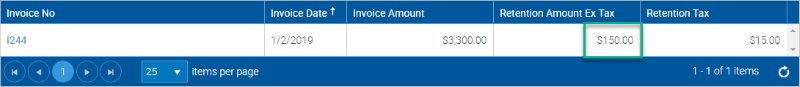

When you generate Progress Claims or standard Invoices, the Retention amounts for each Invoice will be displayed in the Retentions Tab on the Job Card.

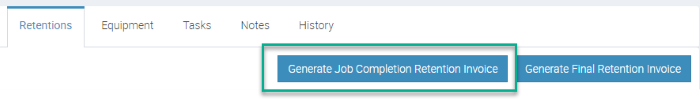

Once the Job has been completed, you will be able to generate the Job Completion Retention Invoice. The value of this Invoice will be based on the total amount of Retentions for the Job and the percentage you set for On Job Completion Amount Ex Tax.

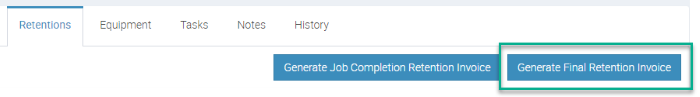

Once the Final Retention amount is due (based on the Retention Period After Job Completion you have set), you can generate the Final Retention Invoice associated with the Job. The value of this Invoice will be based on the total amount of Retentions for the Job and the percentage you set for the After Retention Period – Retention Amount Ex Tax.

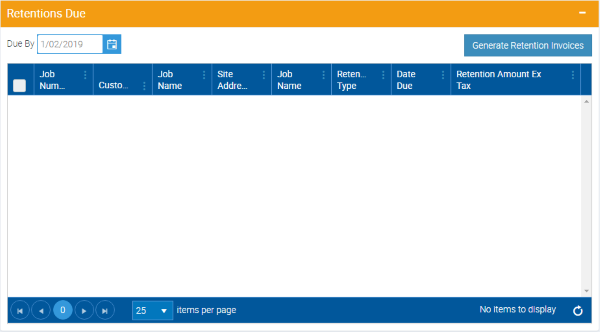

If you have enabled Retentions by default on the Default Settings Screen, once a Job has been completed, the Retentions that are due for the Job will also be displayed on the Dashboard for you to action.